Managing payroll as a freelancer or contractor can be overwhelming and complicated. Making sure that you handle taxes correctly, manage deductions, and follow compliance rules is a lot of work, so working with an umbrella company may offer the help you need. Read below to see how umbrella companies can provide hassle-free payroll services for contractors and freelancers.

What is an Umbrella Company

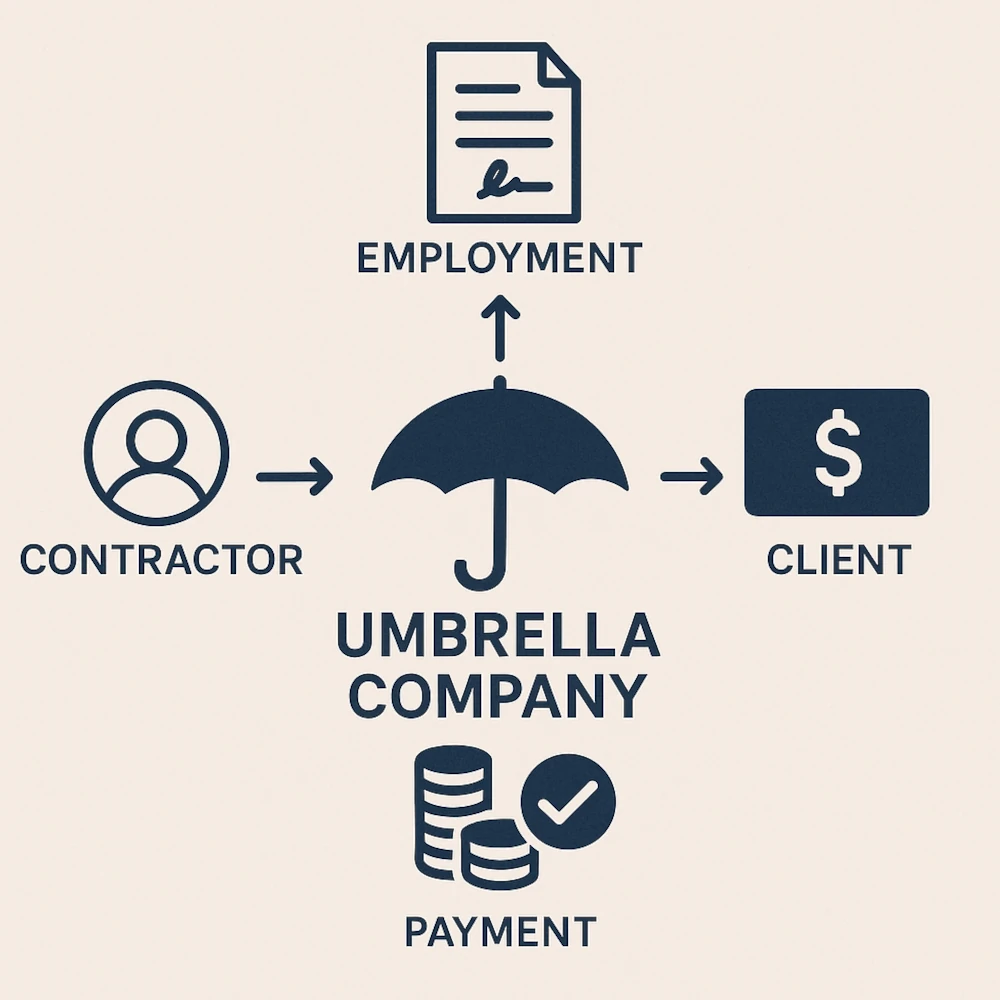

An umbrella company is a third-party business that acts as a go-between for contractors and the companies that they work with. The main role of an umbrella company is to do all of the administrative work for a freelance or temporary worker when they are working on a specific project. Contractors use umbrella companies to help them sort out all of the bureaucracy so that they can focus solely on their current projects. This means that projects can get done faster and paperwork related to the projects can be completed correctly and efficiently.

When working with an umbrella company, a contractor will submit timesheets and expenses to them, and the umbrella company will calculate taxes, insurance contributions, and determine salaries. This shared responsibility relationship works well for both parties and is common in the contracting industry.

Simplifying Payroll for Contractors

If a contractor has a large team of workers that they are in charge of, it is hard to keep track of all of their different hours and how much they are owed. By working with an umbrella company, a contractor simply has to make sure that their employees are filling out timesheets that they can then send to the umbrella company the process. If you are a contractor, you can visit this site to get an idea of all of the ways a reliable umbrella company can help you with your payroll needs. As long as you have timesheets organized and accurate, the umbrella company will do the rest.

Ensuring Compliance and Reducing Risk

When working on a big project, a contractor may not have time to go over paperwork in detail to ensure that all of the information is correct. When working with an umbrella company, the contractor can rest easy knowing that they will double-check all time stamps and things like employee overtime to make sure that all workers are getting paid the correct amount on every paycheck. The umbrella company can also alert contractors if any employees are working too much or not complying with local labor laws.

Streamlining Benefits and Insurance

Beyond payroll management, umbrella companies can also provide help and advice with employee benefits for full-time workers. The umbrella company will communicate with its contractors to make sure they know what they can provide to employees. This can result in happier workers and better business for contractors in the long run. For contractors who work with the same employees on each different job, being able to provide them with benefits is a big plus.

For contractors who are working on overwhelmingly big projects, working with umbrella companies has become commonplace as it makes their jobs much easier and it means that their employees get paid faster and more accurately than if they were trying the tackle payroll services themselves.