Crypto markets in 2025 are a rollercoaster—prices can swing wildly in a matter of hours. For traders, that kind of unpredictability isn’t just stressful; it can be costly. That’s why more people are turning to automated trading strategies. Rather than react emotionally to market shifts, these tools offer structure, discipline, and consistent execution.

BYDFi, a globally recognized crypto exchange, has developed a range of strategy trading features designed to support traders of all levels. In this article, we’ll break down how tools like Grid Trading, Martingale strategies, Dollar-Cost Averaging (DCA), and Copy Trading work on BYDFi—and who they’re best suited for.

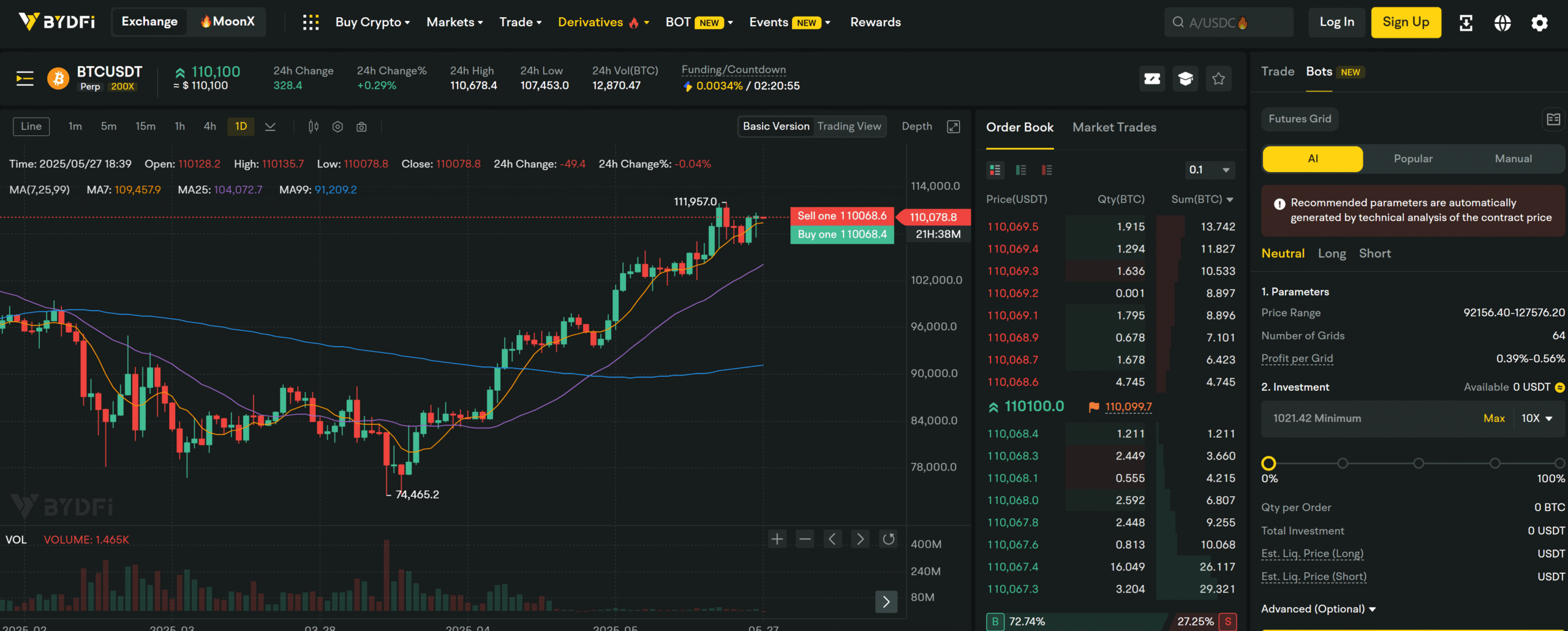

Grid Trading: Catching Swings Without Watching the Charts

Grid trading is a method that splits a price range into multiple segments—each acting like a trigger for buying or selling. The result? Your bot is buying low and selling high, automatically, without second-guessing.

This works especially well in sideways or choppy markets, where prices move within a band.

On BYDFi, here’s what you can set:

· – Price Range: Choose from 1/5 to 5x the current market price

· – Grid Quantity: Between 2 and 99

· – Trigger Price: When a chosen level is hit, the bot kicks in

· – Take Profit & Stop Loss: Optional, but smart to include

– AI Strategy Mode: For newcomers, BYDFi can suggest ready-to-go strategies

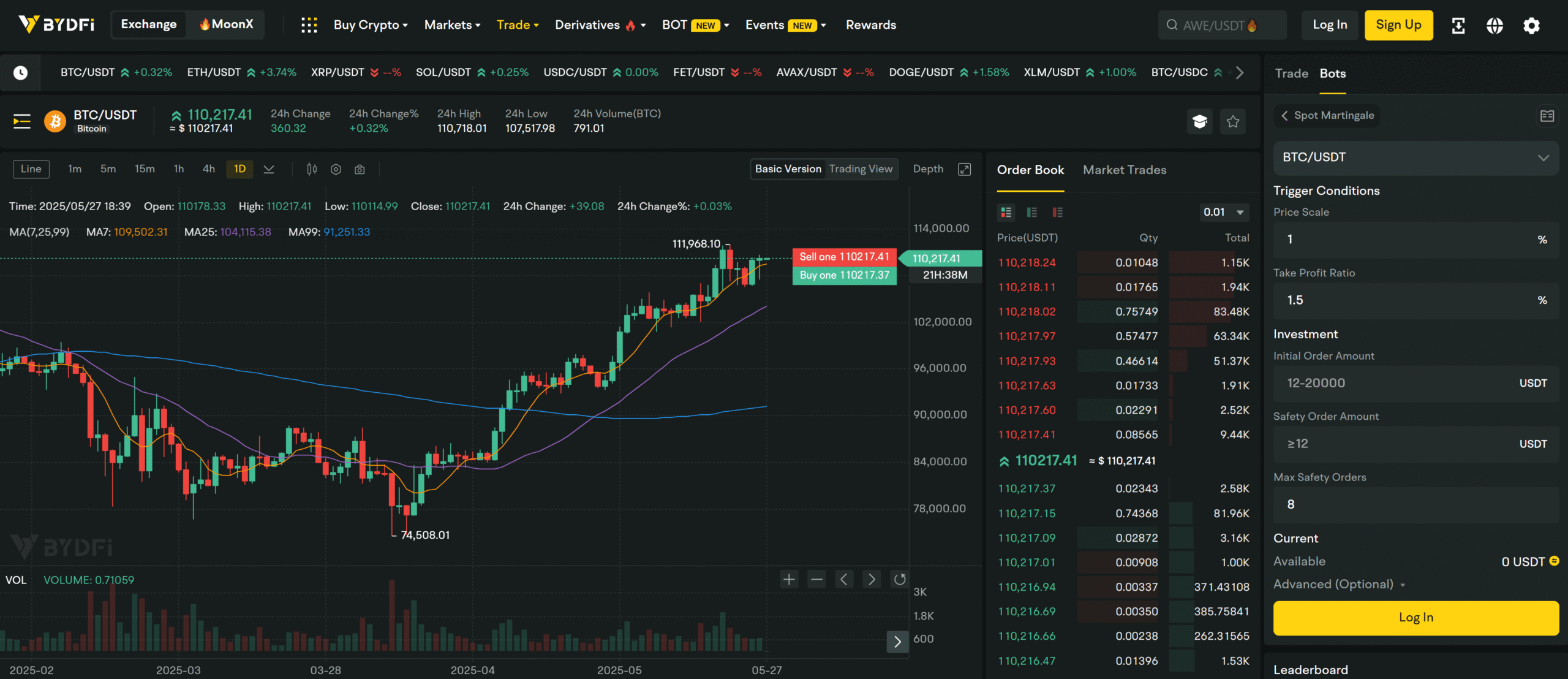

Martingale: A High-Risk, High-Reward Strategy

This one’s not for the faint-hearted. Martingale strategies increase trade size after a loss—aiming to lower your average entry price. If the market bounces back, the strategy can recover losses faster. But it requires careful fund management.

Here’s how it looks on BYDFi:

· – Start Amount: Set your first order size

· – Trigger Level: The point where Martingale begins

· – Safety Orders: Define the number and size of follow-ups

· – Stop Loss / Take Profit: Set your limits in advance

DCA with Spot Investment: A Long-Game Approach

If you believe in crypto long-term, Dollar-Cost Averaging (DCA) might be your style. Instead of investing a lump sum, DCA spreads your buys over time, aiming to reduce the impact of short-term volatility.

What BYDFi’s tool offers:

· – Asset Selection: Choose up to 10 coins

· – Frequency: Ranges from every hour to every month

· – Funding Source: Fiat or crypto

· – Historical ROI: One DCA setup saw 17,000%+ annualized return recently

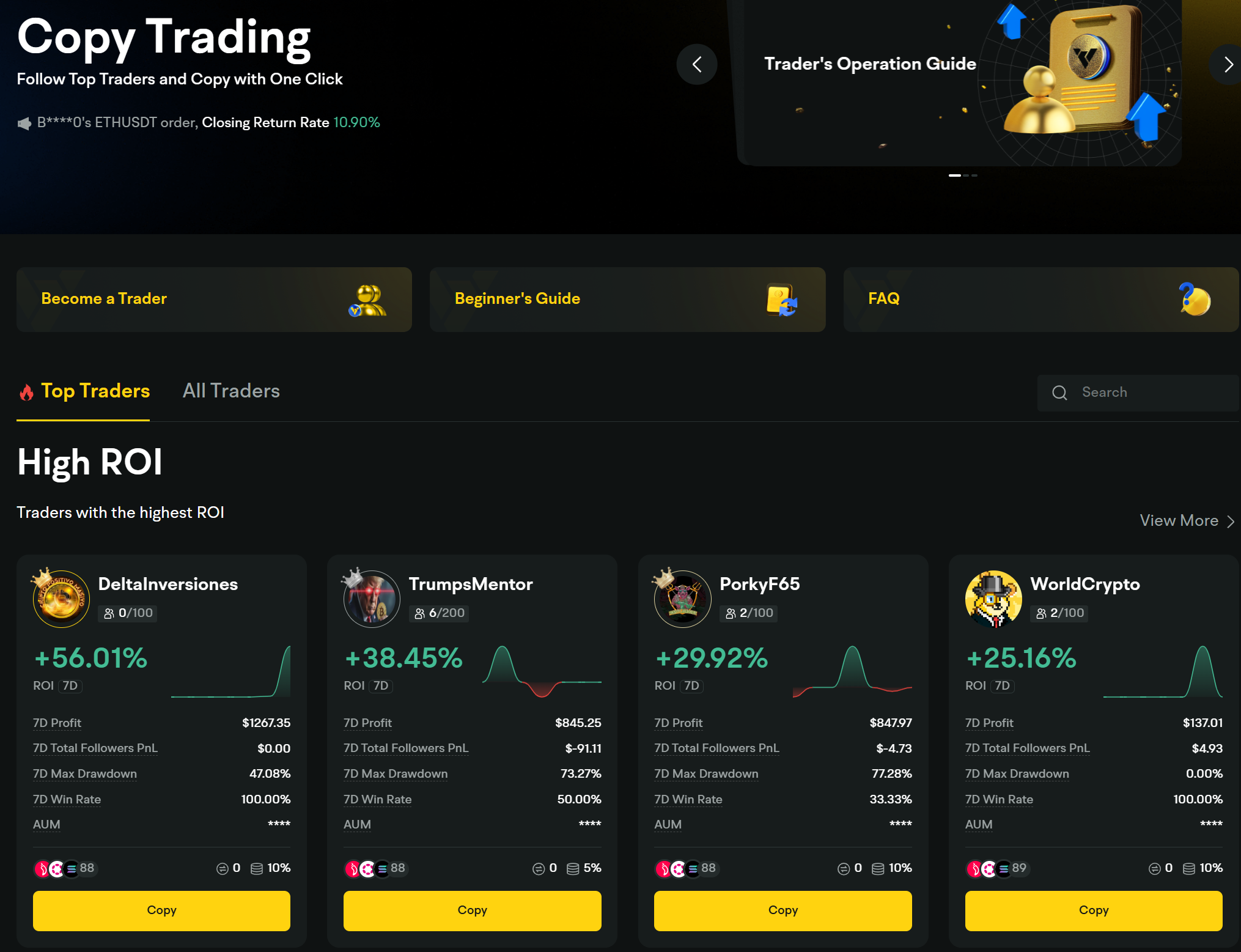

Copy Trading: Let the Pros Take the Wheel

Don’t want to manage strategies yourself? Copy trading lets you mirror experienced traders in real time. You select them based on ROI, riskprofile, and asset preference—BYDFi handles the execution.

Here’s what you can configure:

· – Trader Selection: Choose based on performance and trading style

· – Investment Type: Fixed amount or multiplier

· – Asset Coverage: Includes major coins and trending tokens

· – Leverage: Use up to 200x if you know what you’re doing

Why BYDFi Works for Strategy Traders

Beyond tools, BYDFi brings a lot to the table:

– Competitive fees

– Regulatory credentials like MSB licenses and Proof of Reserves

– Recognized by Forbes, used by over 1 million people

– Security-first: All assets backed 1:1, with audits

– Options for beginners and pros alike

Wrapping Up

Automated strategies aren’t about taking shortcuts—they’re about making consistent, emotion-free decisions. BYDFi’s features give traders a reliable way to adapt to fast-moving markets. Whether you’re looking to fine-tune a short-term strategy or build long-term exposure, their tools help you trade with intention.

Explore BYDFi’s best Trading Bots and find the approach that works for you.